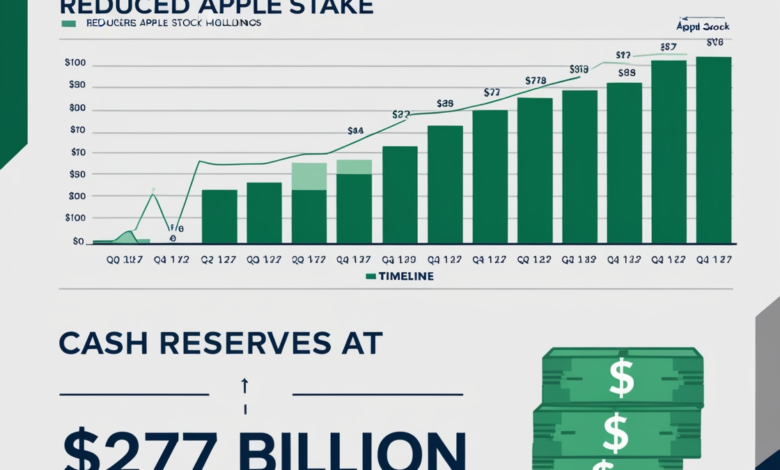

Berkshire Hathaway Cuts Apple Stake, Grows Cash Reserves to $277 Billion

What would you do with $277 billion in cash? It’s a question that gets your imagination racing, doesn’t it? For Berkshire Hathaway, Warren Buffett’s investment giant, this isn’t just a hypothetical. It’s a strategic reality. Recently, the company made waves by slashing its Apple holdings and bolstering its cash reserves to an eye-popping $277 billion. Let’s dive into the why, the how, and what it means for you as an investor.

A Bold Move: Reducing Apple Stake

Apple has long been the crown jewel of Berkshire Hathaway’s portfolio. So, why would Buffett—known for his patient, long-term investing style—decide to sell off part of his stake in one of the most valuable companies in the world? The move is intriguing, to say the least.

Buffett has always emphasized investing in companies with “moats”—unique advantages that protect them from competition. And Apple, with its ecosystem of loyal customers and innovative products, fits the bill perfectly. Yet, this decision signals a shift in priorities. Could it be that Apple’s valuation has reached a point where Buffett sees limited upside? Or is he hedging against potential market downturns?

$277 Billion: A War Chest for Opportunities

Imagine the possibilities with $277 billion. This cash reserve isn’t just sitting idle; it’s a strategic buffer. In uncertain economic times, cash is king. Buffett knows this better than anyone.

Remember the financial crisis of 2008? While others were panicking, Buffett swooped in, making lucrative deals that paid off for years. By increasing cash reserves, Berkshire Hathaway is positioning itself to seize opportunities in a volatile market. It’s a classic Buffett move: patience and preparation.

What It Means for the Market

Berkshire’s decision to reduce its Apple holdings is a subtle but powerful signal. For retail investors like you and me, it’s worth paying attention. Is this a hint that tech valuations might be overheating? Should we be rebalancing our own portfolios to include more defensive assets or cash?

At the same time, the sheer size of Berkshire’s cash reserve could also mean something exciting is on the horizon. A big acquisition? A strategic partnership? When Buffett makes a move, the ripple effects are felt across the financial world.

Berkshire Hathaway’s Portfolio Moves

| Category | Details |

|---|---|

| Apple Stake | Reduced by approximately 50% |

| Cash Reserves | Increased to $277 billion |

| Tech Investments | Overall exposure reduced |

| Potential Acquisitions | Speculated to prepare for large deals |

Let’s Talk About You

Take a moment to reflect. Have you ever felt like the market is too risky? That stocks are too expensive or that you’re not prepared for a downturn? It’s a sentiment many of us share. And it’s why Buffett’s strategy resonates so deeply. He reminds us that it’s okay to step back, hold cash, and wait for the right opportunity.

Now, think about your own financial strategy. Do you have a cash reserve? Are you diversified? What would you do if the market took a sudden turn? These are the questions Buffett’s actions inspire us to ask.

A Personal Anecdote

I remember my first investment mistake vividly. I poured money into a flashy tech stock, thinking I’d found the next big thing. Within months, it plummeted. I had no cash reserve, no backup plan—just regret. That experience taught me the value of patience and preparation—the same principles Buffett lives by. Today, I keep a cash reserve for opportunities and emergencies, and I sleep a lot better at night.

The Emotional Side of Investing

Investing isn’t just numbers on a screen; it’s deeply emotional. Fear, greed, and regret can cloud our judgment. Watching Buffett make bold, calculated moves reminds us that investing is a long game. It’s about staying calm, sticking to your principles, and being ready when opportunity knocks.

Key Takeaways for You

- Patience Pays: Just like Buffett, don’t rush into investments. Wait for the right opportunity.

- Build a Cushion: A cash reserve isn’t just smart; it’s empowering.

- Stay Informed: Pay attention to market signals, but don’t get swept up in the hype.

- Think Long-Term: Short-term gains are tempting, but long-term strategies win the race.

Berkshire Hathaway’s move to cut its Apple stake and amass a $277 billion war chest is a masterclass in strategic investing. It’s a reminder that sometimes, the best move is to step back, reassess, and prepare for what’s next.

So, what’s your next move? Are you ready to navigate the market with patience and purpose? Let’s keep the conversation going. Share your thoughts or questions in the comments below. Let’s learn from Buffett’s wisdom and make smarter financial decisions together.